Traditional Banks

Traditional banks entering digital assets require infrastructure that meets institutional expectations for security, compliance, and operational control. Vaultody provides a non custodial digital asset framework that allows banks to manage, automate, and scale digital asset operations while maintaining full authority over private keys and governance rules.

Trusted Non-Custodial, Platform for Institutional Digital

Asset Management Performance

Traditional banks entering digital assets require infrastructure that meets institutional expectations for security, compliance, and operational control. Vaultody provides a non custodial digital asset framework that allows banks to manage, automate, and scale digital asset operations while maintaining full authority over private keys and governance rules.

Over 100+ teams that trust us with the security of their digital assets

Institutional-Grade Security and Treasury Architecture

Vaultody enables banks to segment their digital asset treasury across multiple vaults, each with its own independent cryptographic key structure. This approach isolates exposure between departments, business units, and client accounts, ensuring that high volume operations maintain strong internal security boundaries

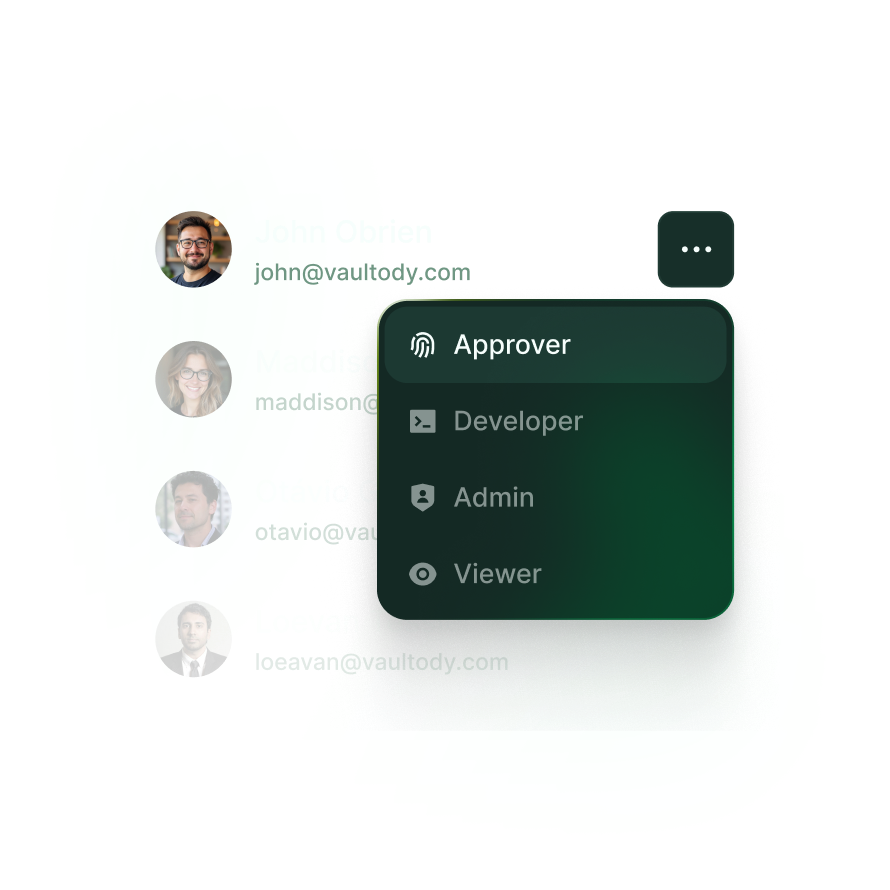

Governance and Role-Based Access Control (RBAC)

Vaultody supports granular role based access control so that transaction initiation, review, and signing can be distributed across teams. A bank may require multiple approvers and separate signers for each transaction, ensuring strong checks and balances aligned with institutional governance models. This structure enforces separation of duties, maintains strict internal controls, and aligns with enterprise compliance expectations. All approvals and signatures are logged cryptographically, providing complete auditability, regulatory visibility, and a clear operational trail without reducing processing speed.

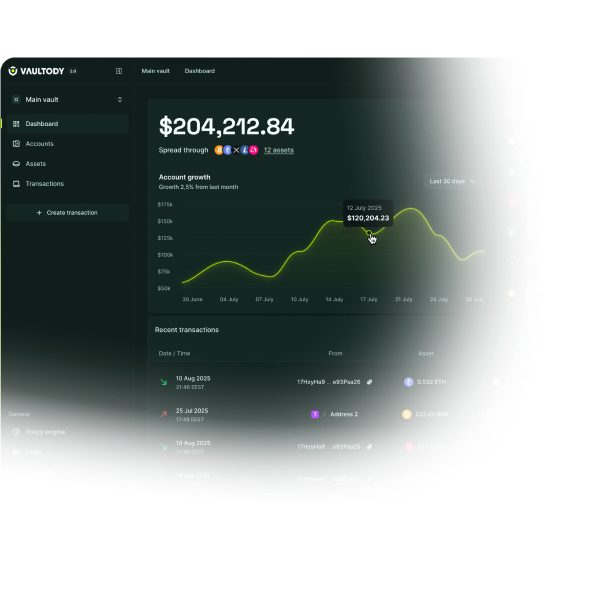

Automation, Compliance, and Operational Efficiency

Vaultody streamlines complex digital asset operations with automated workflows for transfers, settlements, and internal treasury movements. Batch transfer capabilities support bulk activity across multiple accounts, reducing manual workload and increasing operational accuracy. For regulated environments, Vaultody supports AML and KYT integrations so banks can connect their compliance systems directly to transaction flows. Real time monitoring, risk screening, and a complete transaction record ensure readiness for audits, regulatory reporting, and internal reviews at all times.

Enterprise-Ready Features and Extended Capabilities

Vaultody’s intuitive interface provides treasury, compliance, and operations teams with clear visibility into balances, activity, and governance actions. Staking support allows banks to generate yield on approved assets while remaining within the same governed and self custodial framework.

Solutions

Our all-in-one solution offers enterprise-grade non-custodial infrastructure, advanced treasury controls, and API-first Wallet as a Service, built for diverse business needs.

Direct Custody

Treasury Management

Wallet as a Service

Tokenizations

Coming Soon

Stable-coins Operations

Coming Soon

Direct Custody

Treasury Management

Wallet as a Service

Tokenizations

Coming Soon

Stable-coins Operations

Coming Soon

Share the Trust Guard the Keys

Custody stays with you. Security starts here.

Talk to our team to see how Vaultody MPC Core empowers your platform to share trust, guard keys, and own your digital asset future.