Financial Institutions

Financial institutions require digital asset infrastructure that combines security, operational control, and regulatory readiness. Vaultody provides a non-custodial platform designed to help banks, asset managers, and corporate treasuries segment vaults by purpose, automate workflows, and manage multi-chain portfolios with complete control over private keys and governance policies.

Enterprise-Grade Wallet Infrastructure for Financial Institutions

Financial institutions require digital asset infrastructure that combines security, operational control, and regulatory readiness. Vaultody provides a non-custodial platform designed to help banks, asset managers, and corporate treasuries segment vaults by purpose, automate workflows, and manage multi-chain portfolios with complete control over private keys and governance policies.

Over 100+ teams that trust us with the security of their digital assets

Purpose-Built Vaults and Governance Controls

Institutions need to manage diverse assets across reserves, liquidity pools, client accounts, or strategic holdings. Vaultody enables vault segregation per purpose, with each vault having independent cryptographic keys and customizable rules. Role-based access control (RBAC) and co-signer logic ensure that only authorized stakeholders execute transfers, providing robust governance without slowing operations.

High-Volume Transfers and Multi-Asset Support

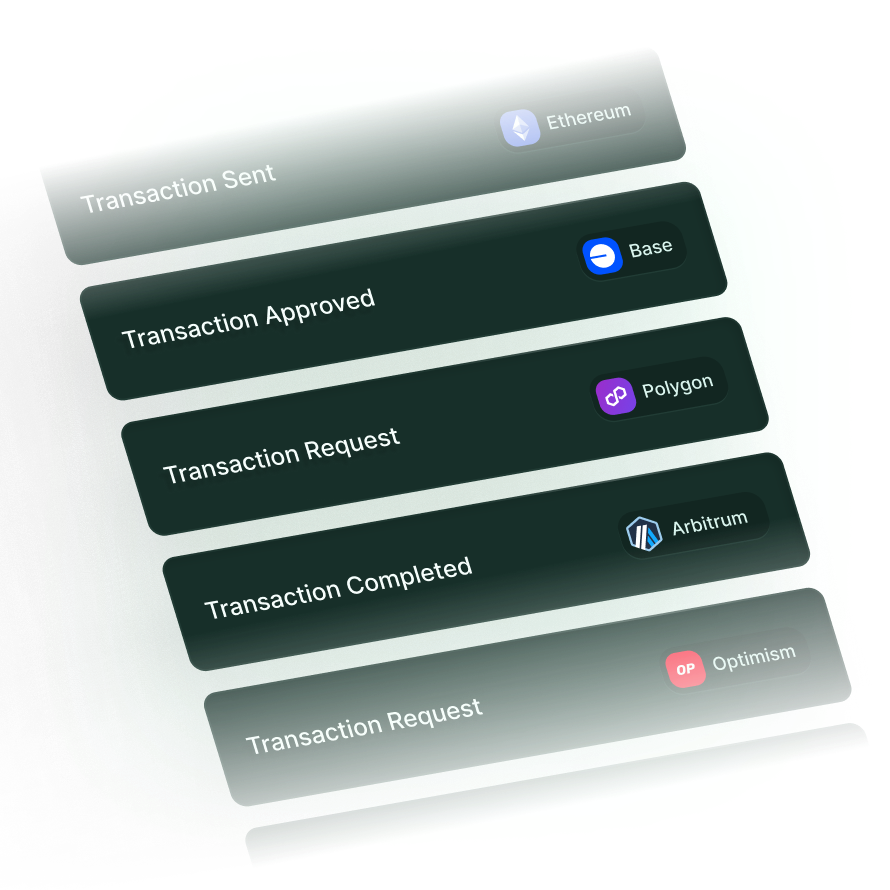

Operational efficiency is essential for enterprise treasury. Vaultody supports batch transfers and automation workflows, allowing teams to process multiple settlements, internal reallocations, or liquidity sweeps in a single, seamless operation. With multi-asset and multi-chain support, financial institutions can manage cryptocurrencies, stablecoins, and tokenized assets across different networks, all within a unified infrastructure.

Compliance, Mobile Approvals and Audit Visibility

Vaultody integrates AML and KYT compliance tools, real-time monitoring, and webhook notifications to provide continuous transparency. Mobile signing capabilities enable executives or compliance officers to approve transactions securely on the go. Every transaction is logged for audit readiness, ensuring regulatory alignment and institutional-grade accountability.

Core System Integration and Enterprise-Grade Operational Alignment

Vaultody connects digital asset workflows directly to core banking systems, treasury platforms, and internal reporting tools via APIs and webhooks. Balance updates, settlements, and vault actions sync automatically, reducing manual reconciliation and improving data accuracy. Institutions gain a unified operational environment where digital asset activity aligns seamlessly with existing risk, accounting, and treasury processes.

Solutions

Our all-in-one solution offers enterprise-grade non-custodial infrastructure, advanced treasury controls, and API-first Wallet as a Service, built for diverse business needs.

Direct Custody

Treasury Management

Wallet as a Service

Tokenizations

Coming Soon

Stable-coins Operations

Coming Soon

Direct Custody

Treasury Management

Wallet as a Service

Tokenizations

Coming Soon

Stable-coins Operations

Coming Soon

Share the Trust Guard the Keys

Custody stays with you. Security starts here.

Talk to our team to see how Vaultody MPC Core empowers your platform to share trust, guard keys, and own your digital asset future.