Frequently Asked Questions

Get answers to commonly asked questions.

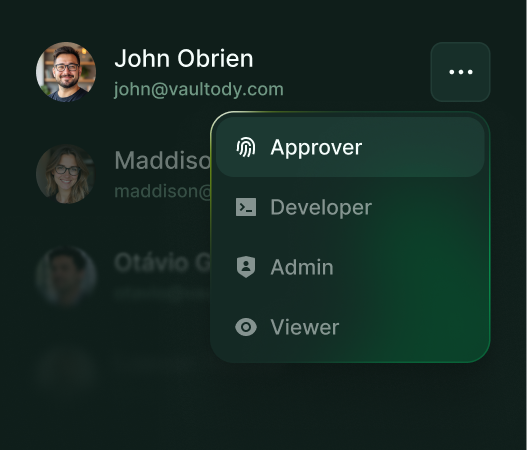

How are approvals, governance, and transaction controls enforced?

Treasury Management includes an adaptive Governance Layer that enforces role-based co-signing, transaction thresholds, limits, and policy rules so sensitive actions require the right approvals before signing. It supports structured workflows and complete audit trails, with mobile authorizations for co-signing and approvals, and optional API co-signing for high-value or sensitive transactions where programmatic control is required.

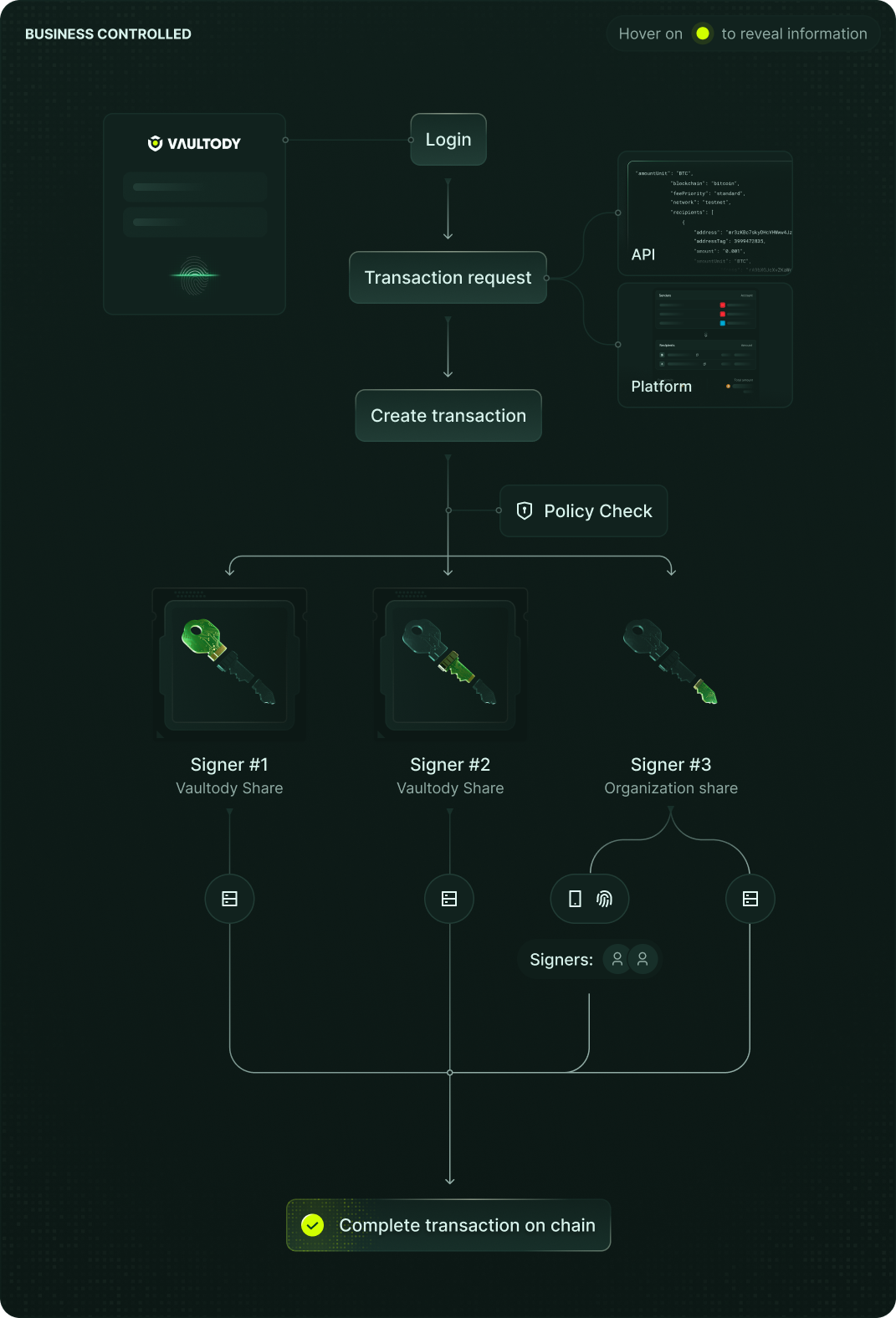

What is the custody model and who controls the keys?

Treasury Management is self-custody infrastructure where the customer is the custodian of their own funds and retains authority over signing policies and private-key control. Vaultody provides the B2B SaaS platform and MPC custody foundation, but Vaultody does not take custody of assets; key shares are distributed and governed by the customer’s operational model, removing reliance on third-party custodians.

Who is Vaultody Treasury Management designed for?

Vaultody Treasury Management is built for corporate treasuries, hedge funds, trading desks, and asset managers that manage their own digital assets and want institutional digital asset management with governance controls. It fits teams that execute fewer, higher-value transactions and need approval workflows, co-signing policies, and clear oversight across treasury, risk, and compliance in a self-custody infrastructure model.

How do teams access and operate the platform day to day?

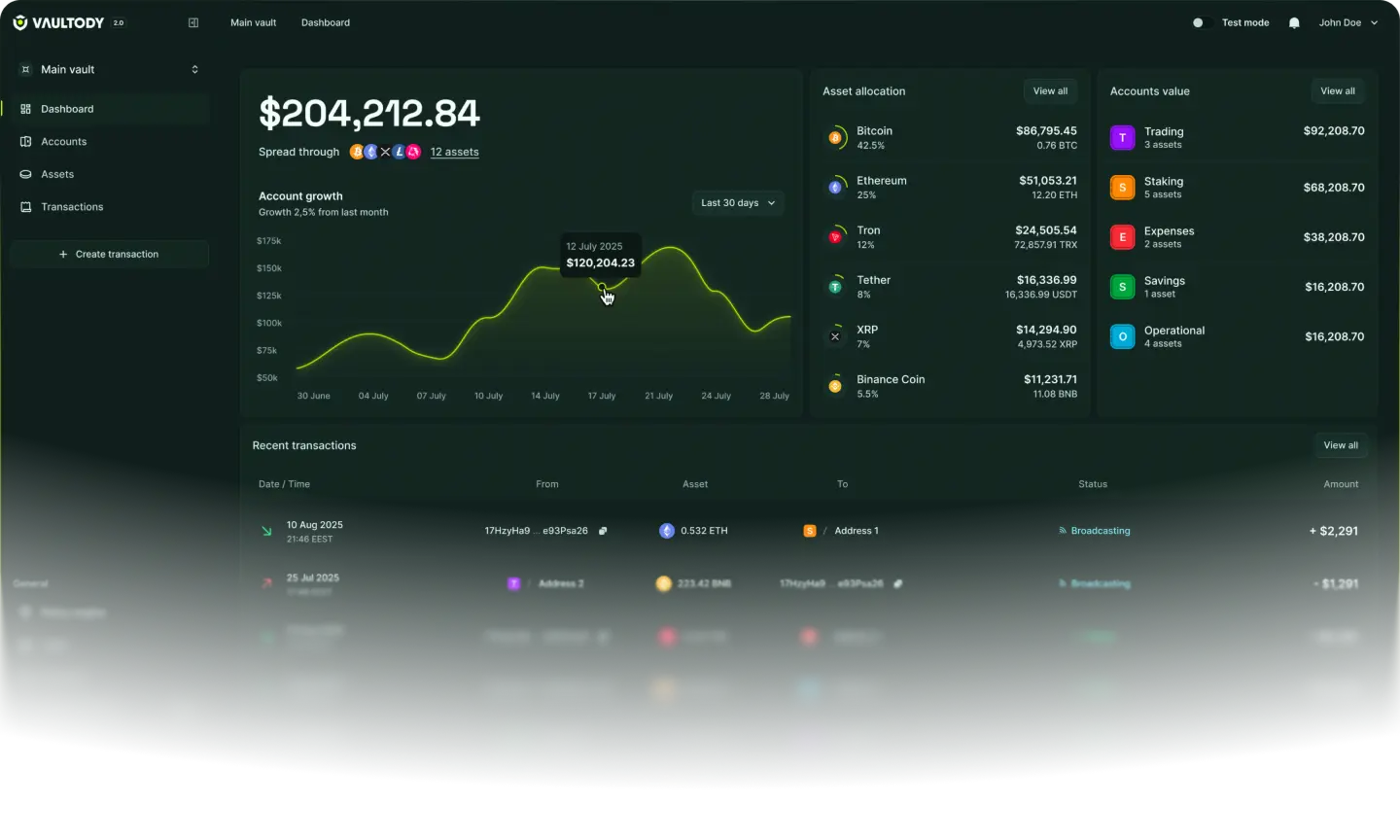

Treasury Management is optimized for controlled, strategic operations using a web dashboard for transacting and oversight, plus mobile interfaces for approvals and co-signing. For organizations that want deeper automation or integration into internal systems, optional API co-signing can be added while keeping governance rules and authorization boundaries intact.

What visibility and audit support does it provide?

Treasury Management provides a unified multi-chain dashboard for real-time balances, activity, and governance insight across supported networks, giving treasury and compliance teams a single operational view. Every transaction and approval event is recorded with an auditable trail so organizations can evidence policy compliance and internal controls without shifting custody to an external provider.