Lending Platforms

Lending platforms demand sophisticated transaction architecture, precise control of borrower assets, and the flexibility to scale across assets and chains. Vaultody offers a non-custodial, enterprise-grade infrastructure tailored for lending workflows, enabling platforms to segment vaults per borrower, automate settlement at scale, and stay in control of asset flows without custody exposure.

Non-Custodial Infrastructure for Crypto Lending Platforms

Lending platforms demand sophisticated transaction architecture, precise control of borrower assets, and the flexibility to scale across assets and chains. Vaultody offers a non-custodial, enterprise-grade infrastructure tailored for lending workflows, enabling platforms to segment vaults per borrower, automate settlement at scale, and stay in control of asset flows without custody exposure.

Over 100+ teams that trust us with the security of their digital assets

Vault Segmentation and Role-Based Access

Each borrower vault operates as an independent account with its own cryptographic key, isolating risk and simplifying financial controls. Vaultody supports role-based access control (RBAC), so operations teams, risk departments, and auditors have clearly defined permissions. Co-signer or threshold authorization logic ensures that transfers, collateral movements, or repayments are executed according to automated governance rules, without manual bottlenecks.

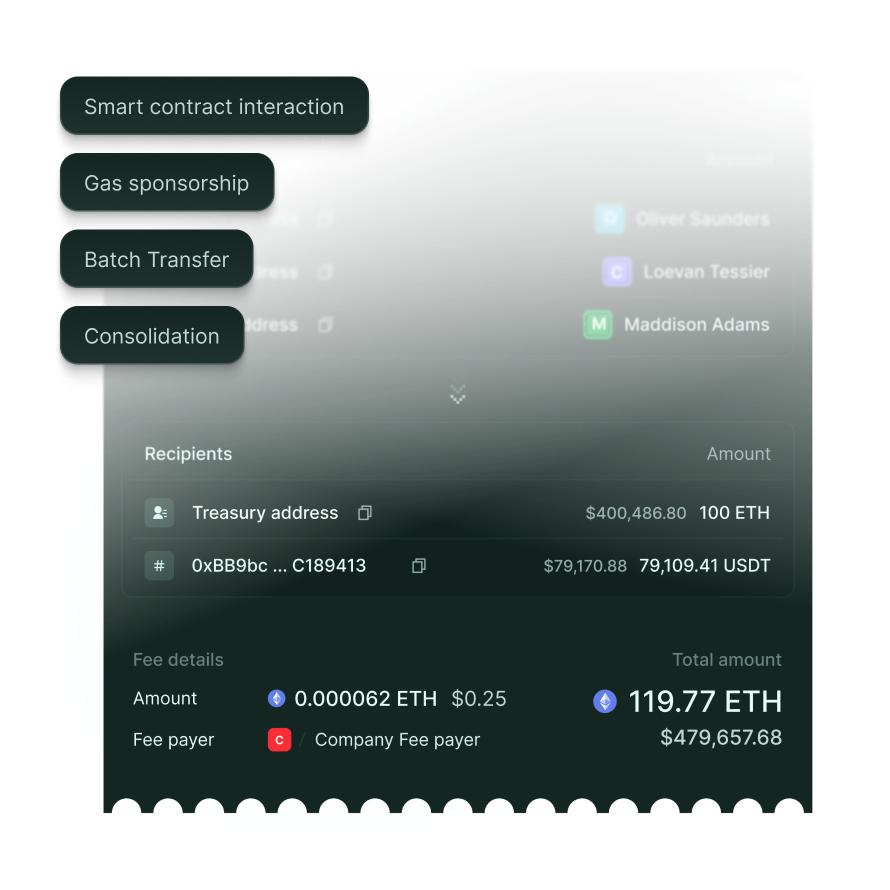

Batch Settlement and Multi-Asset, Multi-Chain Support

Lending platforms often process repayments, collateral release, and interest distributions in volume. Vaultody supports batch transfers, allowing platforms to execute hundreds or thousands of transactions in a single, automated workflow. With multi-asset and multi-chain support, it accommodates lending of cryptocurrencies, tokens, and stablecoins across varied networks, simplifying integration for platforms operating in a global, diversified asset environment.

Adaptable Automation, APIs, and Webhooks

Vaultody’s API-first architecture and webhook event streams enable full programmability of lending operations. Platforms can automate workflows for loan origination, margin calls, collateral sweeps, and borrower settlement, triggered by vault events or external conditions. By embedding control into the infrastructure layer, lenders reduce manual effort and increase operational throughput while staying compliant.

Secure Key Management, Mobile Signing, and Audit Readiness

Security is mission-critical. Private keys remain under borrower or platform control, enforced through MPC (multi-party computation) and hardware security modules (HSM) to eliminate single-point vulnerabilities. Vaultody supports mobile signing capabilities for authorised team members, enabling field-level approvals for critical operations. A complete transaction history and audit log provide full transparency for compliance, helping platforms meet regulatory and investor expectations.

Solutions

Our all-in-one solution offers enterprise-grade non-custodial infrastructure, advanced treasury controls, and API-first Wallet as a Service, built for diverse business needs.

Direct Custody

Treasury Management

Wallet as a Service

Tokenizations

Coming Soon

Stable-coins Operations

Coming Soon

Direct Custody

Treasury Management

Wallet as a Service

Tokenizations

Coming Soon

Stable-coins Operations

Coming Soon

Share the Trust Guard the Keys

Custody stays with you. Security starts here.

Talk to our team to see how Vaultody MPC Core empowers your platform to share trust, guard keys, and own your digital asset future.