Hedge Funds

Hedge funds require high-performance infrastructure to manage digital assets across multiple strategies, portfolios, and markets, while keeping full control over keys and governance. Vaultody provides a non-custodial platform designed to meet the exacting demands of institutional funds, combining security, automation, and operational transparency at scale.

Non-Custodial Solutions & Wallet Infrastructure Crafted For Hedge Funds

Hedge funds require high-performance infrastructure to manage digital assets across multiple strategies, portfolios, and markets, while keeping full control over keys and governance. Vaultody provides a non-custodial platform designed to meet the exacting demands of institutional funds, combining security, automation, and operational transparency at scale.

Over 100+ teams that trust us with the security of their digital assets

Segmented Vault Architecture for Fund Management

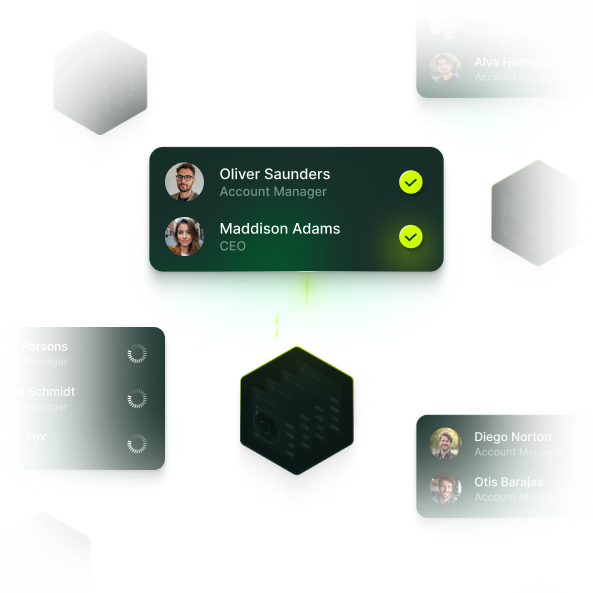

Vaultody enables vaults per fund or strategy, allowing hedge funds to isolate risk, monitor performance, and allocate capital with precision. Each vault is controlled with independent cryptographic keys and configurable access rules. Role-based access control and co-signer or threshold approval logic ensure only authorized team members or systems can execute transfers, balancing operational efficiency with institutional-grade governance.

High-Throughput Operations and Multi-Asset Support

Hedge funds process large volumes of transactions across multiple blockchains and assets. Vaultody supports smart vault batching, batch transfers, and automation workflows to simplify complex operations like liquidity rebalancing, cross-chain asset movement, and reward distribution. Full multi-chain, multi-asset support enables seamless management of cryptocurrencies, stablecoins, and tokenized instruments, while APIs and webhooks provide integration with trading, risk, and fund management systems for real-time visibility.

Governance, Mobile Approvals, and Compliance

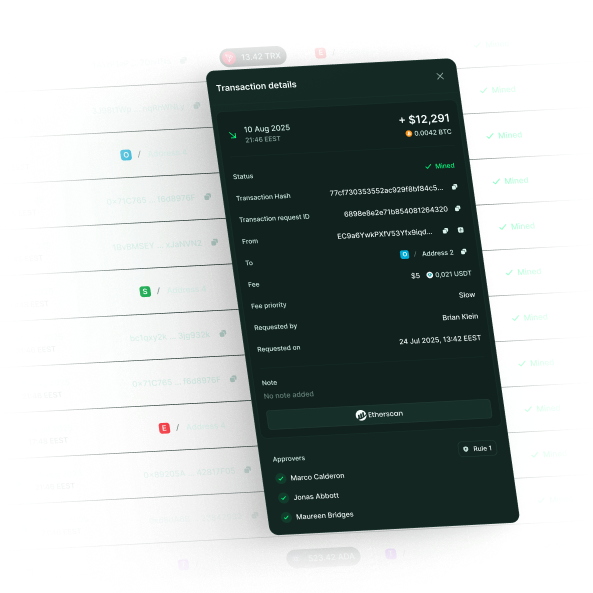

Vaultody’s platform delivers enterprise-ready governance tools. Mobile signing enables executives to approve transactions securely from anywhere, while real-time monitoring, configurable alerts, and detailed audit logs support compliance, reporting, and investor transparency. Combined with automated workflows, funds maintain full operational control without sacrificing speed or security.

Unified Reconciliation and Portfolio Reporting

Vaultody provides hedge funds with a consolidated operational view of all vaults, strategies, and asset movements, reducing manual reconciliation across trading, treasury, and reporting systems. Real-time balance updates, transaction syncing, and event-level logs flow directly into internal dashboards via APIs and webhooks. Teams can verify exposures, track capital movements, and support investor reporting with accurate, audit-ready data, ensuring portfolio oversight remains consistent as strategies scale.

Solutions

Our all-in-one solution offers enterprise-grade non-custodial infrastructure, advanced treasury controls, and API-first Wallet as a Service, built for diverse business needs.

Direct Custody

Treasury Management

Wallet as a Service

Tokenizations

Coming Soon

Stable-coins Operations

Coming Soon

Direct Custody

Treasury Management

Wallet as a Service

Tokenizations

Coming Soon

Stable-coins Operations

Coming Soon

Share the Trust Guard the Keys

Custody stays with you. Security starts here.

Talk to our team to see how Vaultody MPC Core empowers your platform to share trust, guard keys, and own your digital asset future.