Real-World Assets

Real-World Asset (RWA) platforms managing real estate, art, private equity, or carbon credits require infrastructure that is secure, compliant, and operationally efficient. Vaultody provides a non-custodial platform that empowers these businesses to control digital representations of assets, manage investor workflows, and enforce governance without giving up control of private keys.

Fast, Reliable, and Versatile Wallet Infrastructure for Real-World Assets

Real-World Asset (RWA) platforms managing real estate, art, private equity, or carbon credits require infrastructure that is secure, compliant, and operationally efficient. Vaultody provides a non-custodial platform that empowers these businesses to control digital representations of assets, manage investor workflows, and enforce governance without giving up control of private keys.

Over 100+ teams that trust us with the security of their digital assets

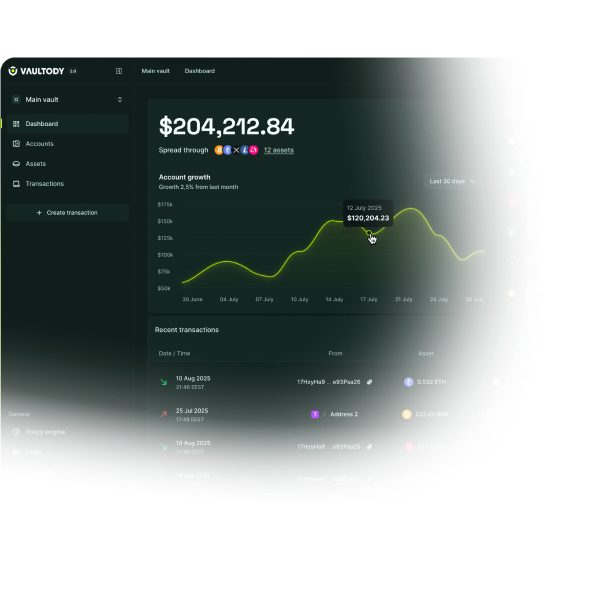

Secure Asset Segregation and Control

RWA platforms need to manage multiple asset classes and investor accounts simultaneously. Vaultody enables dedicated vaults per asset, investor, or operational unit, keeping holdings clearly separated while maintaining full transparency. Platforms can confidently manage distributions, track ownership, and handle lifecycle events knowing each vault is independently secured and auditable.

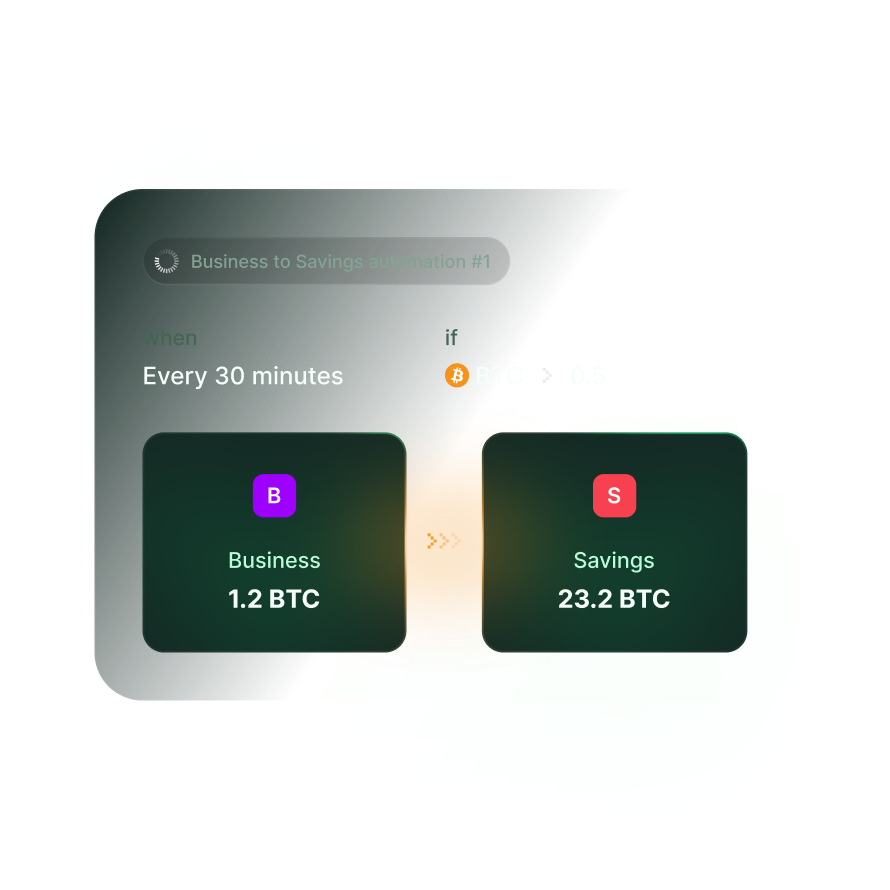

Streamlined Operations and Automation

Vaultody supports API and SDK integrations, batch operations, and real-time webhooks, allowing RWA platforms to automate asset transfers, investor disbursements, and operational workflows. This eliminates manual bottlenecks while providing instant visibility into asset movements and portfolio activity. Platforms can scale operations without compromising security or control.

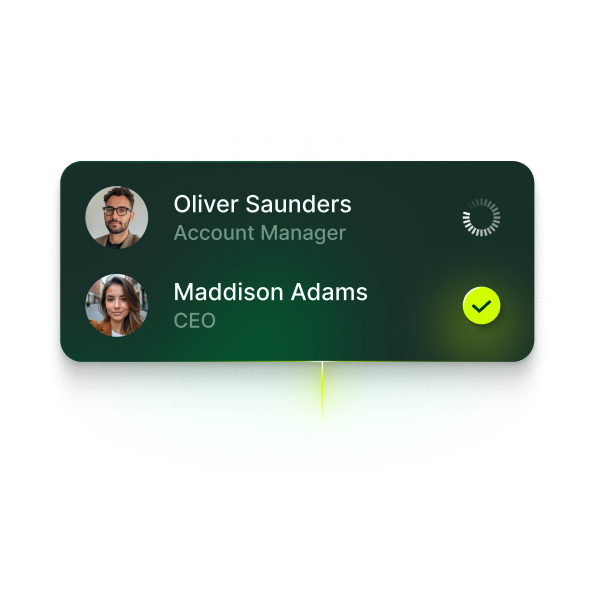

Enterprise Governance and Compliance

Operating under regulatory oversight requires strong governance. Vaultody offers role-based access control (RBAC), co-signer or threshold approvals, and mobile signing workflows, enabling multiple stakeholders to approve or sign transactions as required. Cryptographic key management using MPC and hardware modules ensures that assets remain self-custodied and theft-proof, while comprehensive audit logs and KYT/AML-ready workflows support full compliance.

Lifecycle Management and Asset Event Automation

Vaultody enables RWA platforms to manage asset lifecycle events with precision, including issuance, redemption, revenue distribution, and secondary transfers. Automated workflows trigger actions based on predefined rules or investor activity, reducing manual coordination and ensuring consistency across asset classes. Real-time status updates and event tracking provide operators and investors with clear visibility, helping platforms maintain orderly processes while scaling diverse RWA portfolios.

Solutions

Our all-in-one solution offers enterprise-grade non-custodial infrastructure, advanced treasury controls, and API-first Wallet as a Service, built for diverse business needs.

Direct Custody

Treasury Management

Wallet as a Service

Tokenizations

Coming Soon

Stable-coins Operations

Coming Soon

Direct Custody

Treasury Management

Wallet as a Service

Tokenizations

Coming Soon

Stable-coins Operations

Coming Soon

Share the Trust Guard the Keys

Custody stays with you. Security starts here.

Talk to our team to see how Vaultody MPC Core empowers your platform to share trust, guard keys, and own your digital asset future.