OTC Desks

Over-the-counter (OTC) trading desks and brokerages handle high-value transactions that demand precision, confidentiality, and speed. Vaultody provides a self-custodial wallet infrastructure designed to streamline trade settlement, automate operational workflows, and ensure full control over client assets.

Secure Automated, Non Custodial Infrastructure for

High-Volume Transactions

Over-the-counter (OTC) trading desks and brokerages handle high-value transactions that demand precision, confidentiality, and speed. Vaultody provides a self-custodial wallet infrastructure designed to streamline trade settlement, automate operational workflows, and ensure full control over client assets.

Over 100+ teams that trust us with the security of their digital assets

Purpose-Built for OTC Settlement Efficiency

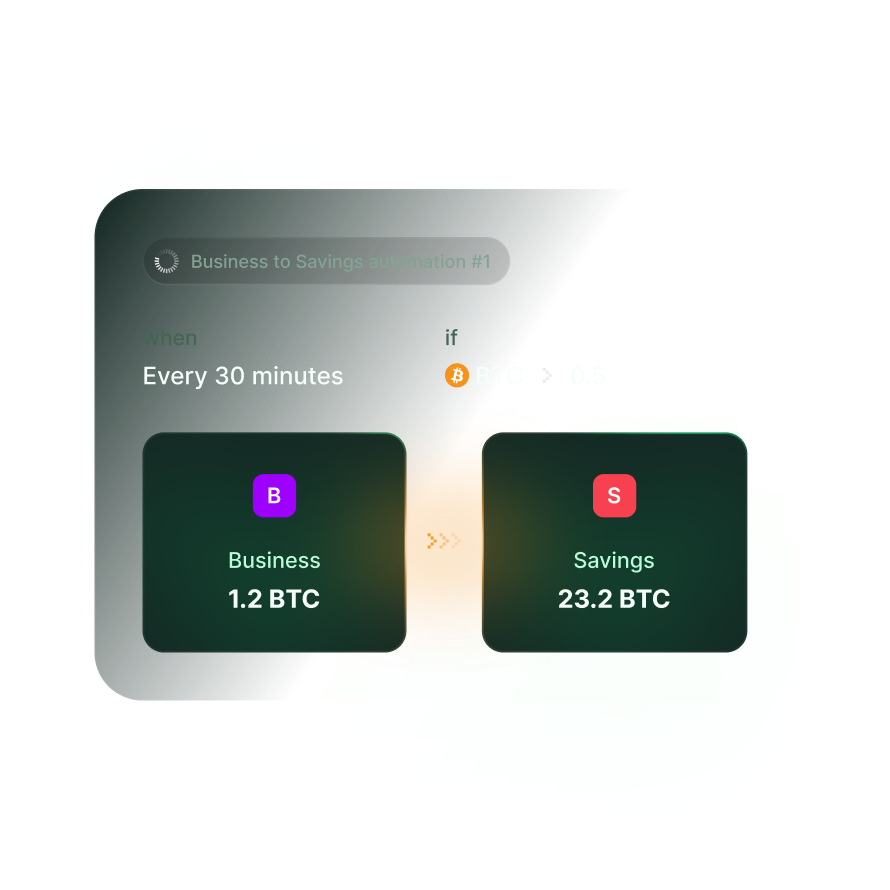

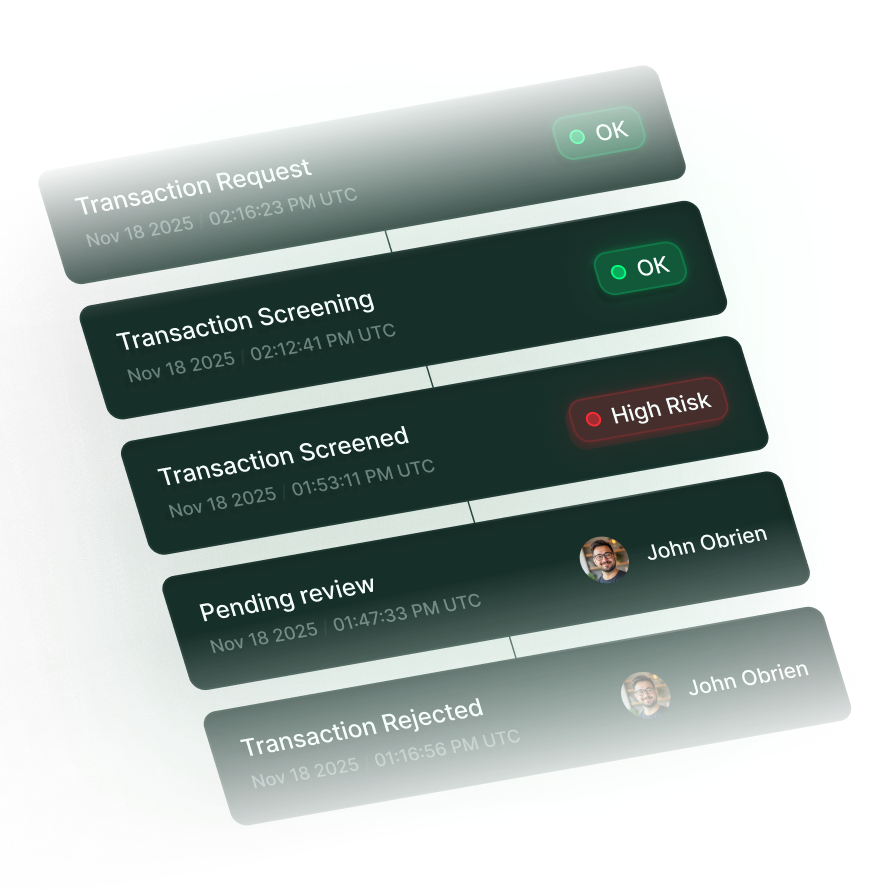

Vaultody’s API-first architecture integrates seamlessly with existing trading and settlement systems to fully automate processes like sweeping, balance management, and confirmations. Each client receives a dedicated wallet address, ensuring clean fund segregation and transparent accounting across all internal and external counterparties. Co-signer functionality enables OTC teams to automate complex transaction logic across systems and treasury operators. Policies can be predefined at the infrastructure level, allowing high-value transactions to execute automatically within secure, auditable parameters. Real-time webhooks eliminate manual bottlenecks by ensuring every movement is processed consistently, maintaining full traceability and control.

Granular Multi-Account Balance Certainty

Vaultody centralizes digital asset management, allowing OTC desks to handle multi-chain activity through a single operational framework. This structure enables teams to optimize transactions using batch processing and smart UTXO management, significantly reducing network fees and maintaining efficiency during periods of heavy volume. The platform offers complete control over fee handling via Net and Gross settlement options. This ensures every transaction—whether fees are deducted or paid by the client—adheres precisely to the intended settlement logic, aligning perfectly with internal procedures and client agreements.

Advanced Automation and Fee Optimization

Vaultody’s fee payer mechanism allows transaction fees to be covered by any designated address within a vault, simplifying reconciliation and cost allocation. Smart batching and sweeping rules reduce manual effort and accelerate settlement cycles, improving turnaround time across high value trades.

Counterparty Settlement Routing

Vaultody introduces structured routing controls that allow OTC desks to define how funds move between counterparties, internal teams, and settlement accounts. Routing rules can be configured for RFQ fills, block trades, and internal transfers, ensuring that each movement follows predictable and auditable paths. Automated sequencing and deterministic routing reduce manual coordination, lower settlement friction, and maintain accuracy across complex OTC workflows.

Solutions

Our all-in-one solution offers enterprise-grade non-custodial infrastructure, advanced treasury controls, and API-first Wallet as a Service, built for diverse business needs.

Direct Custody

Treasury Management

Wallet as a Service

Tokenizations

Coming Soon

Stable-coins Operations

Coming Soon

Direct Custody

Treasury Management

Wallet as a Service

Tokenizations

Coming Soon

Stable-coins Operations

Coming Soon

Share the Trust Guard the Keys

Custody stays with you. Security starts here.

Talk to our team to see how Vaultody MPC Core empowers your platform to share trust, guard keys, and own your digital asset future.