Frequently Asked Questions

Get answers to commonly asked questions.

How does Direct Custody differ from using a third-party custodian or traditional cold storage?

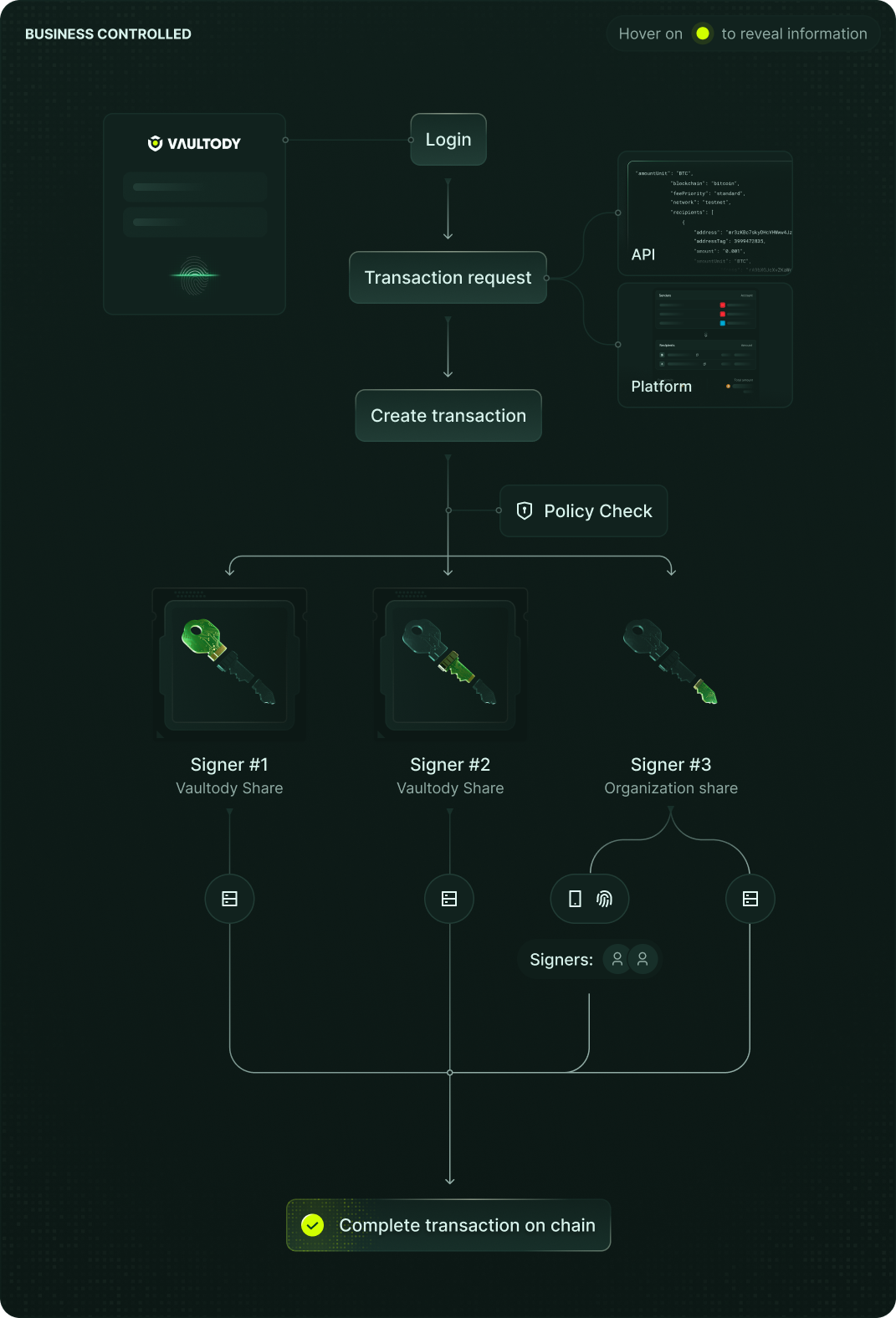

With Direct Custody, the customer remains the custodian of record at all times. Vaultody provides the MPC direct custody infrastructure, but never holds private keys, key shares, or assets. This removes counterparty exposure and avoids dependency on an external custodian’s operational or regulatory posture. Compared to cold storage or single-key wallet setups, Direct Custody replaces static key management with distributed MPC signing, programmable governance rules, and automated transaction handling. This enables real-time operations, policy enforcement, and traceable approvals while maintaining institutional security standards that cold storage alone cannot support.

What types of organizations should use Vaultody’s Direct Custody solution?

Direct Custody is designed for organizations that safeguard and operate digital assets on behalf of their own customers or business users, while retaining full operational and legal control over those assets. Typical customers include centralized exchanges, digital banks, custodians, fintech platforms, payment providers, and asset managers running customer-facing wallet infrastructure. Unlike Treasury Management, which is built for managing a company’s own balance sheet, Direct Custody supports segregated accounts per end customer and high-volume transaction flows. It is purpose-built for environments where governance, automation, and auditability must scale alongside user growth, without introducing third-party custody risk.

How does Vaultody’s MPC custody model protect keys and prevent internal or external misuse?

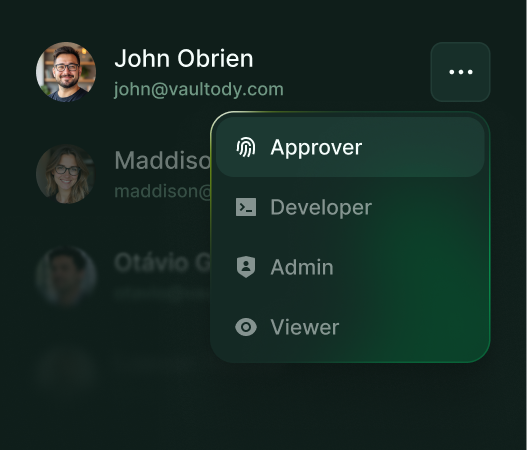

Direct Custody uses MPC t/n signing, where private keys are never assembled and signing authority is distributed across isolated environments. Each Vault can operate with its own signing scheme, ensuring that no single system, individual, or vendor can independently move funds. On top of cryptography, Direct Custody includes a Governance Layer that enforces role-based access control, transaction thresholds, and approval workflows. In high-throughput environments, an automated MPC co-signer evaluates transactions in real time, approving in-policy activity and escalating exceptions for human authorization. Every signature, decision, and approval is fully logged for audit and compliance purposes.

Can Direct Custody integrate with existing exchange, banking, or fintech systems?

Yes. Direct Custody is API-first by design, allowing direct integration with trading engines, payment rails, settlement systems, and internal compliance tooling. Most customers operate Direct Custody primarily through APIs, using the dashboard for oversight and the mobile interface for exception approvals and co-signing. The solution supports high-volume transaction processing while preserving strict governance controls. This makes it suitable for exchange hot wallets, customer deposit and withdrawal flows, internal liquidity management, and operational staking or DeFi activity, all within a single institutional wallet infrastructure.

How does Direct Custody support compliance, audits, and regulatory oversight?

Direct Custody is built for regulated environments where traceability and control are non-negotiable. Each end customer operates within a fully segregated account structure, preserving clean balance separation and simplifying reconciliation and reporting. All actions - from policy changes to transaction approvals and MPC signatures - are recorded with detailed metadata and time-stamped logs. This provides auditors and compliance teams with clear evidence of control, approval lineage, and operational intent, without relying on external custodians or opaque signing processes. Deployment options across on-premises, private cloud, or hybrid environments further support jurisdictional and regulatory requirements.