Introduction

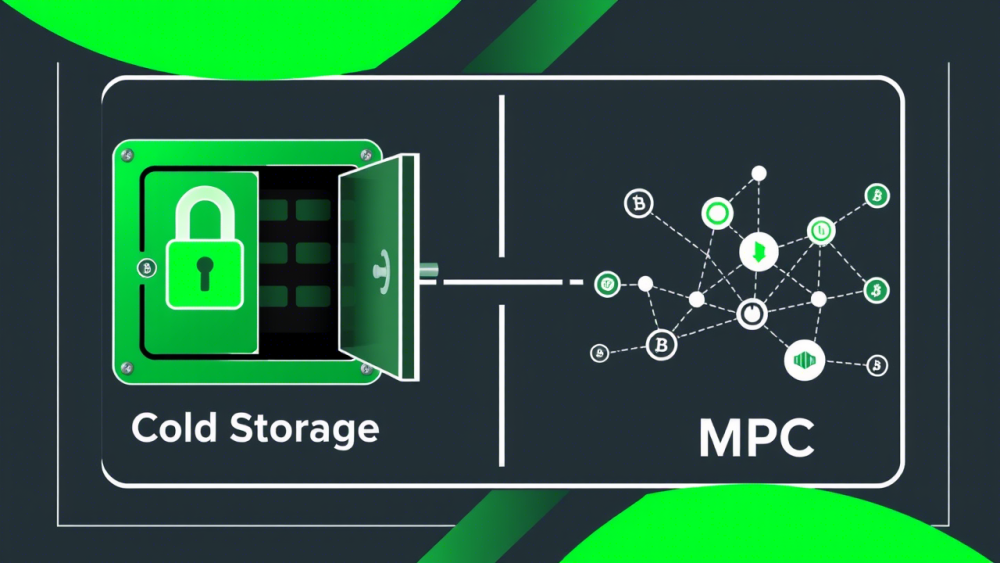

As institutional adoption of cryptocurrencies accelerates, the need for robust yet agile custody solutions has never been greater. While cold storage has been the go-to method for securing digital assets, its limitations in accessibility and scalability are driving organizations toward modern alternatives like Multi-Party Computation (MPC). In this guide, we’ll dissect the pros and cons of cold storage and MPC, demonstrate how Vaultody’s MPC framework addresses critical pain points for institutions, and provide actionable insights to safeguard assets against evolving threats.

1. Cold Storage: Strengths and Limitations for Institutional Use

Cold storage keeps private keys entirely offline, making it a popular choice for securing high-value crypto holdings. However, its operational rigidity often clashes with the demands of modern institutional workflows.

1.1 How Cold Storage Works

- Air-Gapped Hardware: Private keys are stored on devices (e.g., USB drives, specialized hardware wallets) that never connect to the internet.

- Why It Matters: Air-gapping physically isolates keys from online threats, such as malware or remote hacking attempts.

- Geographical Distribution: Institutions often split keys into “shards” stored in multiple secure locations (e.g., bank vaults, private safes).

- Why It Matters: Diversifying storage mitigates the risk of a single physical breach.

- Manual Transaction Signing: To execute transfers, keys must be retrieved, connected to a device, and used to sign transactions offline.

- Why It Matters: This process introduces delays, making cold storage impractical for frequent trading or DeFi activities.

1.2 Strengths of Cold Storage

- Immunity to Remote Hacks:

Offline storage ensures keys cannot be stolen via phishing, malware, or network breaches. For example, exchanges like Coinbase use cold storage to protect the majority of customer funds. - Long-Term Reliability:

Cold wallets have a decade-long track record, making them a “safe bet” for institutions prioritizing familiarity.

1.3 Critical Weaknesses

- Operational Bottlenecks:

Retrieving and manually signing transactions can take hours or days - a dealbreaker for institutions needing to react to market movements. For instance, a trading firm missed a lucrative arbitrage opportunity because its cold wallet approval process took 24 hours. - Human-Centric Risks:

Physical devices can be lost, damaged, or stolen. In 2021, a Canadian exchange lost $140M after its CEO died without sharing access to the company’s cold storage keys. - Scalability Challenges:

Managing thousands of keys across global teams requires significant logistical coordination. A custody bank reported spending 30% of its operational budget on secure hardware and personnel to manage cold wallets.

2. MPC: Reinventing Key Management for Modern Institutions

MPC (Multi-Party Computation) replaces the concept of a single private key with distributed key shards, enabling secure, real-time transactions without exposing the full key.

2.1 How MPC Works

- Key Splitting:

A private key is divided into multiple cryptographic “shares” using advanced algorithms. For example, a key might be split into 5 shares, with 3 required to sign a transaction.- Why It Matters: No single party ever holds the full key, eliminating centralized vulnerabilities.

- Threshold Signing:

To authorize a transaction, a predefined number of parties (e.g., 2 out of 3 team members) collaborate to combine their shares temporarily.- Why It Matters: The key is never reconstructed in full, even during signing, reducing exposure.

- Automated Workflows:

MPC integrates with APIs to enable programmable policies, such as requiring approvals from both a CFO and compliance officer for large withdrawals.

2.2 Advantages of MPC for Institutions

- Zero Single Point of Failure:

Even if a hacker breaches one server or compromises an employee’s credentials, they cannot access the full key. - Real-Time Transaction Speed:

MPC eliminates manual processes, allowing institutions to execute trades, stake assets, or participate in DeFi protocols instantly. - Granular Governance:

Institutions can enforce multi-tiered approval rules for secure transactions.

3. Vaultody’s MPC Model: Bridging Security and Operational Agility

Vaultody’s institutional custody platform combines MPC with enterprise-grade infrastructure to address the shortcomings of cold storage while maintaining unparalleled security.

3.1 Key Features of Vaultody’s Solution

- Distributed Key Shares: Stored across geographically dispersed cloud providers.

- Customizable Policy Engine: Define rules such as multi-user approvals and time-based restrictions.

- API-Driven Automation: Integrate custody directly with trading bots, accounting systems, or compliance tools.

3.2 Vaultody vs. Cold Storage: A Side-by-Side Comparison

| Factor | Cold Storage | Vaultody’s MPC |

| Security | High (offline keys) but vulnerable to physical theft. | Higher (distributed shards, no single point of compromise). |

| Accessibility | Delays due to manual processes. | Real-time transactions via automated policies. |

| Scalability | Limited by hardware logistics. | Scales with cloud infrastructure. |

| Cost | High (hardware, insurance, custodians). | Lower (automation reduces costs). |

| Compliance | Manual audits create overhead. | Built-in audit trails and AML screening. |

4. How Vaultody Mitigates Modern Security Threats

4.1 External Attack Protection

- Phishing/Social Engineering: Attackers must compromise multiple employees or cloud environments.

- Malware/Keyloggers: Key shards are encrypted and never stored on individual devices.

4.2 Internal Threat Prevention

- Rogue Employees: Multi-signature approval prevents unauthorized transactions.

- Third-Party Risks: Vendors or auditors can be granted limited access without exposing full keys.

4.3 Adaptability to Emerging Threats

Vaultody’s MPC architecture supports key-share rotation and policy updates to combat new threats.

5. Why Institutions Are Prioritizing MPC Over Cold Storage

- DeFi and Staking Integration: MPC enables instant delegation to staking pools or liquidity protocols.

- Regulatory Compliance: Vaultody provides immutable logs for audits, meeting standards like MiCA and FATF Travel Rule.

- Competitive Differentiation: Institutions using MPC offer faster settlements and lower fees.

6. Transitioning to MPC: Best Practices for Institutions

- Start with Hybrid Custody: Use cold storage for redundancy while using MPC for daily operations.

- Leverage Vaultody’s APIs: Automate reconciliation and risk monitoring.

- Train Teams on MPC Workflows: Ensure employees understand approval chains and security protocols.

Conclusion

While cold storage remains a viable option for long-term “deep freeze” storage, Vaultody’s MPC model offers institutions a future-proof solution that balances security with agility. Upgrade Your Crypto Security Today and Explore Vaultody’s MPC Custody Solutions.

Copy link

Copy link